Understanding the S&P 500 and Its Current Market Trends

Introduction to the S&P 500

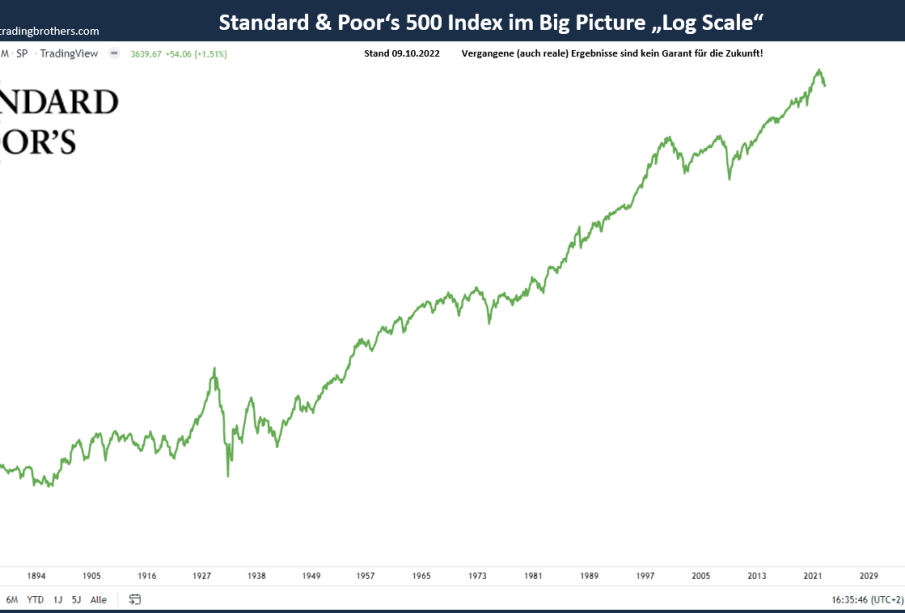

The S&P 500, or Standard & Poor’s 500, is one of the most important benchmarks for the U.S. stock market, encompassing 500 of the largest publicly traded companies. Its performance is often used to gauge the overall health of the U.S. economy and, by extension, the global markets. With its recent fluctuations, understanding the S&P 500’s trends and movements is crucial for investors, particularly as they navigate the potentially volatile market conditions in 2023.

Recent Market Trends

As of October 2023, the S&P 500 has experienced notable volatility attributed to multiple economic factors, including inflation concerns, Federal Reserve interest rate policies, and ongoing geopolitical tensions. After a significant decline earlier in the year, many analysts noted a recovery phase during the summer months, which has resulted in the index stabilizing at moderately higher levels.

The S&P 500 saw a sharp increase in investor interest in technology stocks following quarterly earnings reports that surpassed expectations. Companies in the technology sector, such as Apple and Microsoft, have shown resilience, leading to substantial contributions to the index’s performance. In contrast, sectors such as energy and consumer staples faced challenges due to fluctuating commodities prices and changing consumer behavior.

Impact of Economic Indicators

Several key economic indicators influence the S&P 500’s performance, including unemployment rates, consumer confidence, and inflation metrics. Recent reports indicate that the U.S. unemployment rate remains low, supporting spending growth. However, inflation continues to pressure the consumer price index (CPI), which the Federal Reserve is closely monitoring as it considers further interest rate adjustments.

Conclusion and Future Outlook

Looking ahead, analysts suggest that the S&P 500 will continue to experience fluctuations in response to economic data releases and geopolitical events. Investors should pay close attention to the earnings forecasts for key sectors and the Federal Reserve’s policy decisions as they may significantly impact market stability. For Canadian investors, understanding the trends within the S&P 500 not only informs potential investment strategies but also allows for broader market insight that could influence global economic conditions.