Understanding the Canada Pension Plan (CPP)

Introduction to the Canada Pension Plan (CPP)

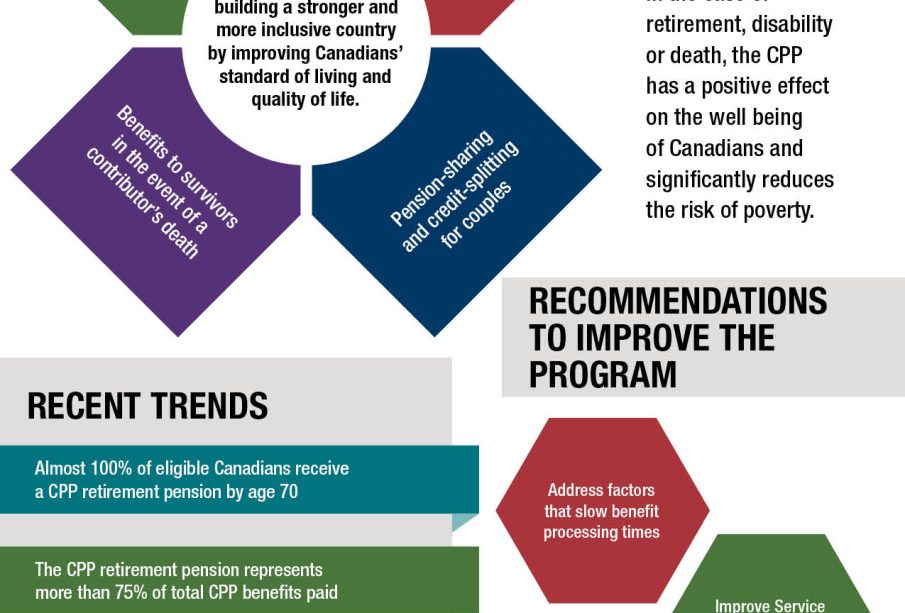

The Canada Pension Plan (CPP) is a significant pillar of Canada’s social safety net, providing retirement, disability, and survivor benefits to millions of Canadians. Established in 1966, the CPP is crucial for ensuring financial security in retirement for individuals across the country. As life expectancy increases and the population ages, the discussions around the sustainability and enhancement of the CPP have become more relevant than ever.

Recent Developments in the CPP

In September 2023, the Canada Pension Plan Investment Board (CPPIB) reported a 5.5% annual return for the fiscal year, emphasizing the fund’s resilience despite global economic challenges. The CPP currently provides benefits to over 5 million Canadians, with the average monthly payout for new beneficiaries set at approximately $1,154 in 2023. This figure highlights the relevance of the CPP as a primary source of income for retirees.

This past year, the federal government also discussed potential reforms aimed at expanding the CPP to ensure long-term sustainability and improve benefits for future retirees. Key proposals include gradually increasing contribution rates to bolster the fund and potentially introducing additional benefits for low-income retirees.

The Importance of CPP for Canadians

As many Canadians may rely heavily on CPP for their retirement income, understanding its structure and benefits is crucial. The CPP is funded through mandatory contributions from both employees and employers. For the year 2023, the contribution rate is set at 5.95%, with a maximum pensionable earnings threshold of $66,600. Self-employed individuals contribute both the employee and employer parts, totaling 11.9%.

Moreover, the CPP provides a valuable safety net during unforeseen circumstances, such as disability. This aspect of the plan underscores its role in supporting Canadians not just in retirement but throughout their working lives.

Conclusion

In summary, the Canada Pension Plan (CPP) plays an essential role in the financial well-being of Canadians. With ongoing discussions about enhancements and sustainability, individuals are encouraged to consider their retirement planning strategies carefully. As reforms are debated and implemented, it is significant for Canadians to stay informed about how these changes could impact their future benefits and overall financial security.