Understanding IREN Stock: Recent Developments and Future Outlook

Introduction

The IREN stock, representing the well-established company, has gained significant attention in the financial markets. As investors continue to seek solid opportunities amidst economic uncertainty, understanding the dynamics surrounding IREN stock is crucial. With trends indicating potential growth, evaluating the importance of this stock is not just relevant for traders but also for long-term investors looking to diversify their portfolios.

Recent Performance and Key Developments

As of October 2023, IREN stock has experienced notable fluctuations influenced by broader market trends and company-specific news. In the past quarter, IREN stock rose by approximately 15%, outpacing many sector peers. Analysts have attributed this surge to the company’s recent strategic initiatives, including expansion into renewable energy projects and enhancements to their existing infrastructure.

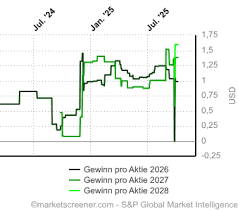

The company’s quarterly earnings report, announced last week, exceeded market expectations, showcasing a 20% increase in revenue year-over-year. This growth has been driven by higher demand for their services and successful cost management strategies implemented by the management team. Furthermore, institutional investors have shown increased interest in IREN stock, with several hedge funds acquiring significant stakes, indicating strong confidence in the company’s future performance.

Market Reaction and Analyst Forecasts

The market’s reaction to IREN’s latest performance has been cautiously optimistic. Most analysts maintain a ‘buy’ rating, signaling a favorable outlook over the next 12 months. Many believe that the company is well-positioned to capitalize on emerging trends in sustainability and technology improvements. However, they also caution investors to keep an eye on regulatory challenges that could affect operational efficiency.

Conclusion

The trajectory of IREN stock remains a focal point for both current and prospective investors. With promising growth driven by strategic developments, the company’s outlook appears robust. Investors are advised to remain vigilant and consider various factors, including market conditions and corporate governance, while making decisions. As IREN continues to innovate and adapt, it could very well emerge as a key player in the industry, making it a stock worth monitoring closely.