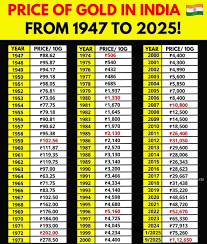

Current Trends in Gold Price in India – September 2023

Importance of Monitoring Gold Prices

The gold price in India is a significant economic indicator and holds great importance for investors, traders, and consumers alike. As a country that is the second-largest consumer of gold in the world, fluctuations in its price can have widespread implications on market sentiment and individual purchasing power.

Current Gold Prices and Trends

As of September 2023, the gold price in India has experienced volatility due to various factors, including global economic conditions and changes in U.S. dollar value. The price per gram of 24K gold has hovered around ₹5,850-₹6,000, showing an increase compared to previous months. This rise can be attributed to several factors, including inflation concerns and a strong demand for gold as a safe-haven asset.

Global Influences Affecting Prices

The international gold market is heavily influenced by the Federal Reserve’s interest rate decisions, geopolitical tensions, and currency fluctuations. Recently, the U.S. Federal Reserve has indicated a cautious approach towards interest rate hikes, which, in turn, has bolstered gold prices globally. Such global trends inevitably affect the Indian market, contributing to the recent surge in prices.

Impact on the Jewelry Market

The increase in gold prices has led to a slowdown in the jewelry sector, as consumers are now more hesitant to make large purchases. According to industry reports, jewelry sales dropped by approximately 15% in August compared to last year, as potential buyers are opting to wait and see if prices stabilize before making significant investments.

Future Outlook

Economic analysts suggest that gold prices may continue to fluctuate in the coming months due to ongoing uncertainties in the global economy. Investors are advised to keep a close eye on market trends and global economic policies that may directly or indirectly influence gold prices in India.

Conclusion

As we move through September 2023, the gold price in India is poised for potential shifts due to several economic factors. For consumers and investors alike, staying informed about these changes is crucial to making informed decisions. Understanding market dynamics and global influences will be key for anyone looking to navigate the complexities of gold investing in India.