CoreWeave Stock: Insights and Market Performance in 2023

Introduction

CoreWeave, a leading cloud computing company specializing in GPU-based workflows, has become a noteworthy player in the stock market. As the demand for high-performance computing continues to grow, understanding the nuances of CoreWeave’s stock is crucial for investors and industry enthusiasts alike.

Market Trends and Performance

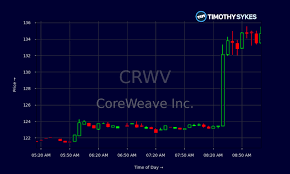

As of October 2023, CoreWeave’s stock has seen significant fluctuations in response to broader market conditions and its rapid expansion into services that cater to AI workloads. The company went public earlier this year, providing investors with access to its innovative cloud solutions. Initially, the stock surged due to a robust demand for cloud computing services, especially from sectors heavily reliant on graphics processing units (GPUs). According to recent reports, CoreWeave’s revenue has doubled over the last year, showcasing its rapid growth.

In the latest quarterly earnings report, CoreWeave boasted a 150% increase in revenue year-over-year, driving investor confidence. Notably, its partnership with various tech firms, including those focusing on artificial intelligence, has established CoreWeave as a competitive force in a booming market. This alignment with AI technologies has brought renewed attention to its stock as many investors pivot towards companies that can capitalize on the technological advancements in this domain.

Challenges Ahead

Despite its growth potential, CoreWeave faces challenges that could affect its stock performance. Increased competition in the cloud computing market, along with ongoing supply chain issues in the semiconductor sector, poses risk factors. Analysts suggest that while the company’s offerings are strong, maintaining its growth trajectory will require sustained innovation and strategic partnerships.

Conclusion

In conclusion, the performance of CoreWeave stock remains a popular topic among investors as the company carves out its niche in the rapidly evolving technology landscape. With its current growth being fueled largely by the increasing demand for high-performance computing solutions, many analysts predict a promising yet cautious outlook. Potential investors should keep an eye on market trends and CoreWeave’s strategic initiatives as these will play crucial roles in its future success. Given the volatile nature of tech stocks, particularly in a post-pandemic economy, careful analysis and an informed investment strategy are advisable.