Understanding Spy Stocks: Trends and Investment Outlook

The Rise of Spy Stocks

In an era defined by rapid technological advancements and heightened national security concerns, spy stocks have garnered increasing attention from investors. Spy stocks refer to shares in companies involved in surveillance, cybersecurity, and intelligence services. With ongoing geopolitical tensions and the need for robust security systems, these stocks present unique investment opportunities.

Market Trends and Current Events

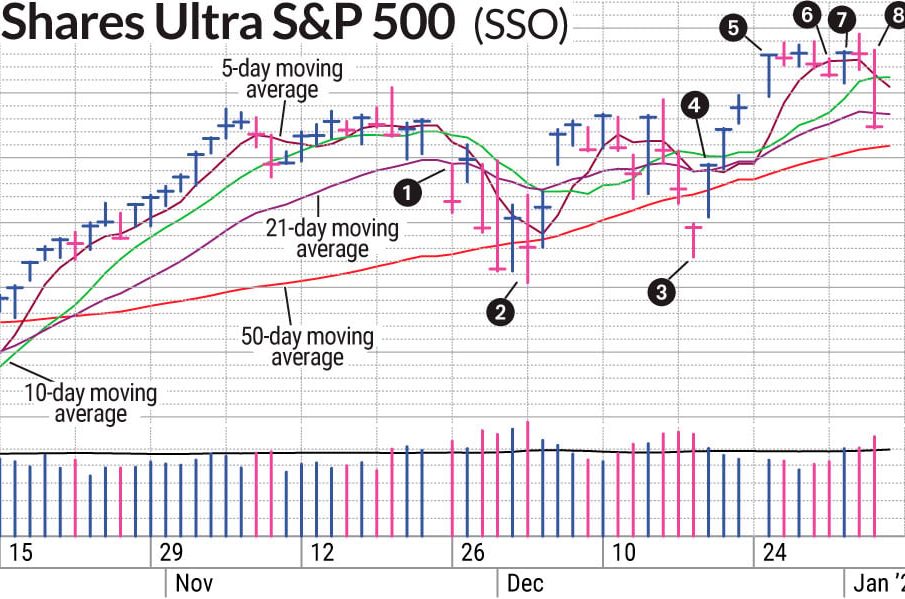

As of late 2023, the spy stock market has seen significant fluctuations, influenced by factors such as regulatory changes, government contracts, and advancements in technology. According to a report from MarketWatch, the global cybersecurity market is expected to reach $345 billion by 2026, growing at a compound annual growth rate (CAGR) of 10.2%. Major players in the sector, including companies like Palantir Technologies and Booz Allen Hamilton, are securing high-profile contracts with government agencies, fueling their stock prices.

In recent weeks, heightened security measures in response to international cyber threats have prompted increased investments in spy technologies. For example, the U.S. government’s bipartisan push to strengthen cyber defenses has resulted in a surge of funding to cybersecurity firms. Investors are closely monitoring these developments, as they often dictate the performance of spy stocks on the stock market.

Investing in Spy Stocks

For those considering investments in spy stocks, it is crucial to recognize the volatility associated with this niche market. Economic downturns, shifts in government spending, and public scrutiny can significantly impact stock performance. Analysts recommend conducting thorough research and monitoring news on cybersecurity policies that affect company growth.

Moreover, investors should diversify their portfolios by including a mix of established firms and emerging startups within the spy sector. This approach can mitigate risks while capitalizing on the evolving landscape of security technologies.

Conclusion

In conclusion, spy stocks represent a compelling opportunity for investors looking to capitalize on technological advancements in security and surveillance. With the ongoing global focus on cybersecurity and national defense, the sector is poised for continued growth. As always, potential investors are advised to stay informed of market trends and governmental policies that may impact their investments in this dynamic arena. The outlook for spy stocks in 2023 remains optimistic, reflecting both the challenges and opportunities in an increasingly digital world.