Current Status and Future Trends of Canada Central Bank Interest Rates

Introduction

The Bank of Canada, the nation’s central bank, plays a crucial role in the economic landscape by setting interest rates that influence borrowing, spending, and inflation. Understanding the dynamics of central bank interest rates is essential for consumers, investors, and businesses alike, as they can significantly impact economic activities and financial markets.

Current Interest Rate Trends

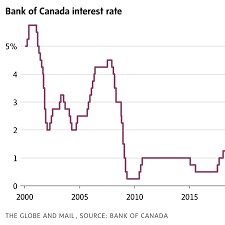

As of October 2023, the Bank of Canada has maintained its benchmark interest rate at 5.00%, a decision made during their latest policy statement earlier this month. This rate has remained unchanged since January 2023, following a series of increases throughout 2022 aimed at combating rising inflation, which surged to a 39-year high of 8.1% last June.

The central bank’s decision to avoid further increases reflects a careful balancing act amid emerging signs that inflation may be cooling. According to the latest Economic Update, the inflation rate dropped to 4.0% in September, indicating that previous measures are starting to take effect. Economists suggest that a stable interest rate may provide consumers some respite, allowing the economy to adapt and recover following extensive interest hikes.

Economic Implications

Higher interest rates generally lead to increased borrowing costs for consumers and decisions to delay spending or take on new loans. This is particularly relevant for the housing market, where mortgage rates have significantly increased over the past year, leading to a slowdown in both sales and new construction. As such, there is an ongoing concern about the housing affordability crisis in Canadian cities.

The Bank of Canada’s current stance seems aimed at promoting economic stability. However, analysts remain divided on whether the central bank’s decision to hold rates steady will continue, with some forecasting potential cuts in early 2024 should inflation trends persist in the right direction. Others warn that lingering global uncertainties and domestic economic pressures may prompt the bank to keep rates elevated for a more extended period.

Conclusion and Future Outlook

As Canada navigates a complex economic environment marked by inflationary pressures and changing global dynamics, the Bank of Canada’s decisions on interest rates will remain pivotal. The next scheduled meeting of the central bank is set for December 2023, when updated economic assessments could lead to adjustments in their policy.

For consumers, keeping a close eye on interest rate trends will be crucial as these changes will impact everything from mortgage payments to savings growth. A continued focus on economic indicators will help various stakeholders better anticipate the Bank’s potential movements and plan accordingly.