The Current State of Tesla Stock and Market Insights

Introduction

Tesla stock has become a benchmark for electric vehicle (EV) manufacturers and a significant player in global markets. With the company at the forefront of the EV revolution, interest in its stock has surged, making it a hot topic among investors and analysts alike. Staying updated on Tesla’s stock performance is crucial for current and prospective investors given the company’s influence in the automotive sector and beyond.

Recent Trends and Performance

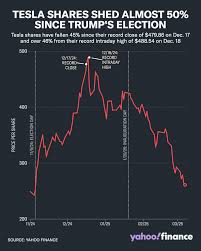

As of October 2023, Tesla’s stock has experienced notable fluctuations. After hitting an all-time high in late 2021, the stock witnessed a downturn largely due to broader market corrections and supply chain disruptions that affected the automotive industry. However, recent reports indicate a recovery with shares trading at approximately $260, a more than 15% increase from earlier this year.

Analysts attribute this rebound to positive quarterly earnings reports that exceeded Wall Street’s expectations. The company reported a significant increase in vehicle deliveries, fueled by strong demand in growth markets like China and Europe. Furthermore, substantial investments in battery technology and production facilities have positioned Tesla to capitalize on the increasing demand for EVs.

Strategic Moves and Future Outlook

Tesla continues to innovate and lead in the EV market, with new model releases and expansions into new geographical territories. Plans to open a gigafactory in Texas and further advancements in autonomous driving technology could drive Tesla’s growth in the coming years.

Experts are divided on Tesla’s long-term valuation. Some analysts advocate for a bullish outlook citing the company’s dominance and innovation in EV technology, while others caution against potential overvaluation in a highly competitive market with emerging competitors like Rivian and Lucid Motors.

Conclusion

In conclusion, Tesla stock remains a vital asset for investors to monitor, given its market influence and innovative capabilities. As the EV market continues to expand, Tesla’s strategic moves and ability to adapt to market demands will play a crucial role in its performance. Investors should keep a close eye on quarterly earnings, production numbers, and market trends to navigate the complexities surrounding Tesla stock. With both risks and opportunities ahead, staying informed will be key for those looking to invest in this dynamic company.